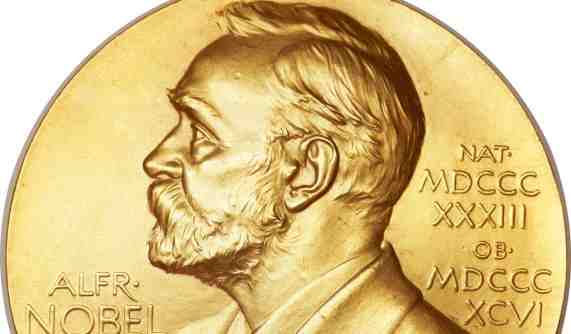

Recently, the 2013 Nobel Prize in Economics was given to three professors for “their empirical analysis of asset prices”. Eugene Fama, Lars Peter Hansen, and Robert Shiller were awarded the prize for their groundwork in determining that stock prices are hard to predict in the short time, easier in the long term, and have already incorporated news events into their pricing. In other words, don’t expect to get in and out quickly and swing a profit. Of course, we knew that already because our financial advisors have continuously drilled that into our heads from day one. Sit tight on your stocks, ignore the volatility, and rest assured that things eventually work themselves out. A diversified portfolio in the stock market has been proven historically to be the safest bet for investment return. And as much as the advisors have liked saying those words, (it simplifies their job tremendously,) we have loved hearing them. Who wouldn’t want to lovingly accept the promise of guaranteed returns? Combine that with the absolute proof of historical-statistical modeling, and you’ve got yourself one sold customer. So what are we missing? Why have ironclad norms not provided us with a nation of ecstatic retirement investors? (Please let me apologize in advance. Dissecting stock prices often causes an automatic churning wrenching response which very often leads to snappishness, surly looks at your coworkers, and general dissatisfaction with life, the universe, and everything. As if the lousy coffee you had this morning wasn’t enough of a day breaker already.) It turns out that contrary to the expert exhortations, stock prices have not always followed such a happy go-uppy route. They’ve seen their highs, and they’ve seen their lows, and it seems that you have to pick your 30 year period at just the right place to see the promised returns. A few years back, Bloomberg reported that for the 30 year period ending in 2011, stock returns did not beat out bonds in term of profits. Now Bloomberg is certainly a fan of Wall Street, but when they see the numbers, they’ll report them. And that’s just Bloomberg. There’s a growing contingency of academics and economists who are questioning the prevailing common wisdom with numbers of their own. You can fully expect that with the extreme volatility of the contemporary market, more and more people in the know will start to question how we invest our money.